Financial Literacy Program

Our financial literacy programs aim to change how young people think about their personal economics and their financial management. We teach financial literacy as a Life Skill something that everyone regardless of their job or career needs to know and understand while also encouraging informed decision making. We currently serve over 500 young people every year. We offer year-round classes in Brockton (and by Zoom to other places in Massachusetts) we teach economic and financial literacy concepts including budgeting and savings. We offer programs for a range of ages, but the focus is middle school. In addition, our Investment Club, run during the school year for middle and high school students in partnership with BASE Chicago, provides students an opportunity to simulate investments in real stocks and participate in a nationwide stock investing competition.

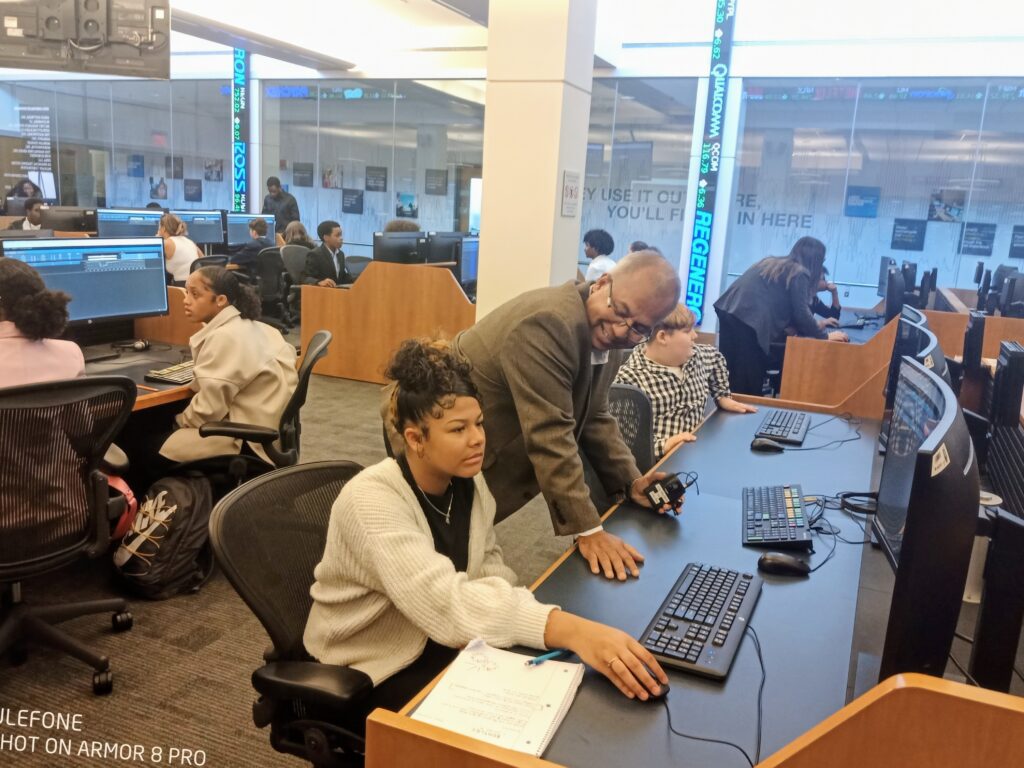

In 2024, Empower Yourself students took the top five positions in this competition with over 300 participants, our students won over 18k in prize money that they used to fund their investment portfolio and college planning. A lot of our student success can be accredited to the tremendous relationship we have Bentley University. Bentley allows our students to come to their trading room multiple times a year and teach our students how to trade and too understand financial markets. More importantly, Bentley provides our students opportunities within the Bentley Community.

Beyond the impact we have by working directly with students from lower-income families, we advise schools and train teachers on how to deliver their own year-round financial literacy classes. We also support schools in creating their own investment clubs.

These programs are intentionally designed to drive towards our intended outcomes and overall goal as an organization.

Financial Literacy Program Schedule

Week 1 |

|

Week 2 & 3 |

|

|

Week 4 |

|

Week 5 |

|

Week 6 |

|

Week 6 – 8 |

|

Week 9 – 11 |

|

Week 12 |

|

Week 13 & 14 |

|

Week 14 |

|

Week 15 |

|

Week 16 |

|

Outcomes

With a good financial education our students has a good grasp on their own financial & economic outcomes but also a good grasp of financial markets and how they work.

List Of Programs

Our Literacy Partners